On December 17, 2024, the DC Council gave final approval to the Downtown Arena Revitalization Act, locking in over half a billion dollars in taxpayer-funded renovations for Capital One Arena. The deal ensures the Washington Capitals and Wizards stay in DC through at least 2050.

That means the Mayor and your City Council members (all Democrats or “independent” Democrats) signed off on this massive capital investment for a billionaire’s play space—just weeks after Donald Trump was re-elected. Your tax dollars on corporate welfare layaway, and they’re not done yet.

With the new year and 2025 inauguration, Mayor Bowser and several high-profile Councilmembers kicked off a tour cheering on the return of the Washington Football Team to a revitalized RFK Stadium—a project that could cost DC taxpayers hundreds of millions, if not a billion dollars, to fund yet another luxury sports venture.

Then in February, the U.S. President demanded DC city officials address the growing “unsightly” tent encampments. DC Mayor, Muriel Bowser acknowledged Trump's directive and on March 7, 2025, she sent in bulldozers to destroy encampments sheltering DC residents already displaced by the city’s worsening affordability crisis—giving unhoused residents just one day's notice to vacate, a clear departure from the city’s usual 14-day policy. She then turned those machines on Black Lives Matter plaza that has really upset Jamie Foxx among others.

And now, that same DC Mayor and the whole gaggle of DC City Councilmembers stand before a Republican-controlled federal government, pleading for mercy—asking Congress not to slash $1 billion from DC’s local budget, warning of devastating impacts to human services and vital programs.

The gaslighting feels staggering.

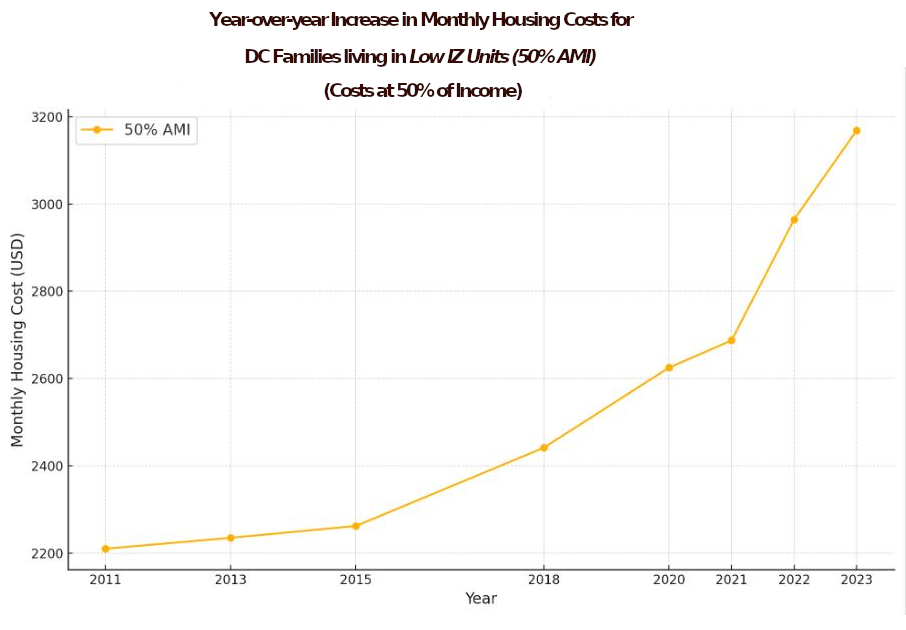

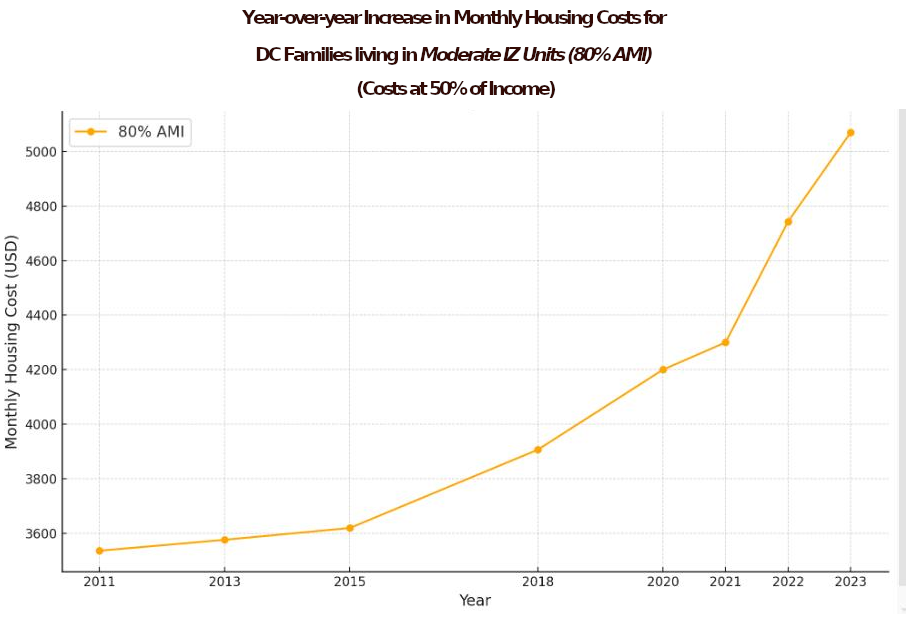

Year after year, DC’s leaders prioritize giving away public property and financing to construct stadiums, luxury condos, and high-end hotels—while barely maintaining scraps of funding for truly affordable housing. Worse yet, they continue to annually flirt with cutting housing vouchers, emergency rental assistance, and critical social services that working-class and poor residents rely on for survival, including the most recent legislation making it easier for slumlords to evict struggling working DC families from their homes (warning: link to gov spin website).

Democrats, Republicans—two sides of the same coin?

—